how much is the nys star exemption

In this example 400 is the lowest of the three values from Steps 1 2 and 3. Exemption forms and applications.

What Is The Enhanced Star Property Tax Exemption In Nyc Hauseit

To qualify the adjusted gross income must be under the State specified limit for the required income tax year 500000 for Basic 86300 for Enhanced and is eligible for a yearly 2 increase in the tax savings.

. The Enhanced STAR exemption amount is 70700 and the school tax rate is 21123456 per thousand. In New York State the homestead exemption known as STAR for School Tax Relief allows homeowners in some counties to deduct as much as 1635 from their property taxes while those over 65 can deduct up to 2940. Senior citizens whose annual incomes exceed 60000 will be eligible for the basic STAR exemption.

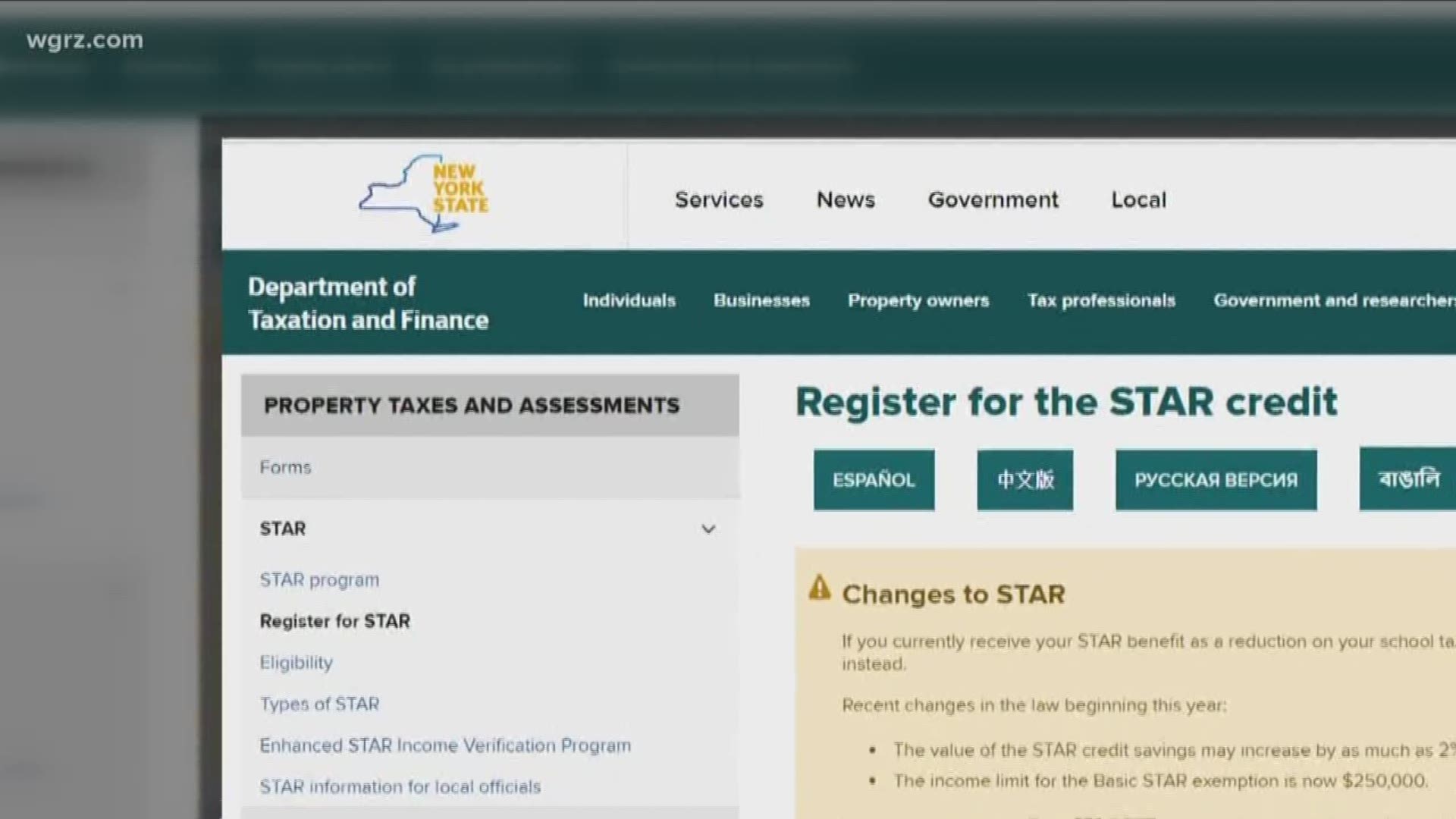

For those earning between 75000 and 150000 the rebate is 60 of what you receive in STAR. 70700 21123456 1000 149343. While the maximum annual income eligibility requirement for Basic STAR remains unchanged at 500000 whats changed is that only those whose income is 250000 or less will be able to continue to receive exemptions on their property tax bill.

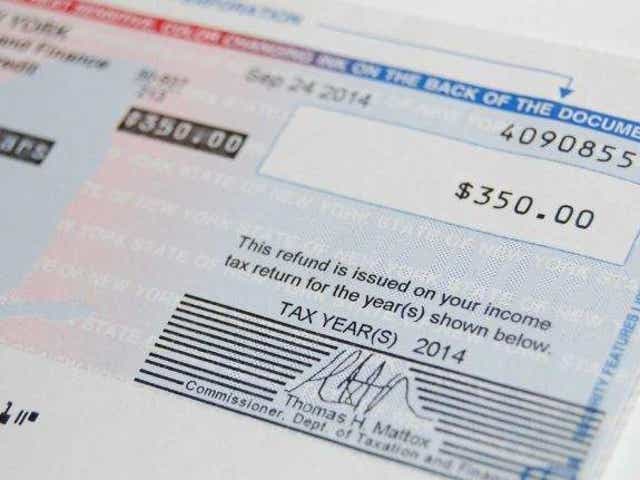

If youre eligible for the STAR credit youll receive a check for the amount of your STAR savings. Call 311 Outside New York City call 212-NEW-YORK Nassau County residents Glen Cove residents should follow the general application instructions above STAR forms. The formula below is used to calculate Basic STAR exemptions.

If youve been receiving the STAR exemption since 2015 you can continue to receive it for the same primary residence. The Enhanced STAR exemption amount is 70700 and the school tax rate is 13123456 per thousand. In the second box if you got a check related to Star credit.

You are a Yonkers resident. The enhanced STAR exemption will provide an average school property tax reduction of at least 45 percent annually for seniors living in median-priced homes. You can receive the STAR credit if you own your home and its your primary residence and the combined income of the owners and the owners spouses is 500000 or less.

Seniors will receive at least a 50000 exemption from the full value of their property. What is the income limit for enhanced star in NY 2020. If you will be 65 or older in the year which you apply and have had a STAR exemption on your property in 2015-16 you can apply for Enhanced STAR E-STAR.

New York City residents. 88050 or less for 2020 benefits 90550 or less for 2021 benefits These benefits apply only to school district taxes. 92000 You may be eligible for Enhanced STAR if you will be 65 or older in the calendar year in which you apply.

STAR begins with a household income of 50000 or less for homeowners who are considered Basic STAR. The benefit is estimated to be a 650 tax reduction. A reduction on your school tax bill.

The dates pertain to assessing units that publish their final assessment rolls on July 1. Those making between 250000 and 500000 will instead receive a check from New York State. You do not need to do anything on your 2016 federal and New York State income tax returns unless you meet one of the following conditions.

How much do you save with enhanced star. Enhanced STAR is for homeowners 65 and older whose total household income for all owners and spouses who live with them is 92000 or less. Since its inception in the 1990s STAR gave homeowners with annual incomes under 500000 an upfront rebate on their school taxes.

The exemption applies for schools and city taxes for. As long as you. How Much Is The Star Exemption In Ny.

You must register with NY State online at wwwtaxnygovstar or over the phone at 518-457-2036. 88050 or less for the 2020-2021 school year 90550 or less for the 2021-2022 school year. This is estimated to result in a tax savings of 293 per year.

34 what they get from Enhanced STAR regardless of their income. 5 rows If you are currently receiving STAR or E-STAR as a property tax exemption and you earn. Annually for each school district segment the amount of savings as a result of the STAR exemption cannot exceed the savings of the prior year.

The total amount of school taxes owed prior to the STAR exemption is 4000. Senior citizens also get a check. How much will my STAR exemption check be.

Step 4 Obtain your municipalitys local school property tax rate. At what age do you stop paying property taxes in New York State. For more information see STAR credit and exemption savings amounts.

It is 35 for households with income between 150000 and 200000 and 105 for between 200000 and 275000. How much is NYS Enhanced STAR exemption. The Maximum Enhanced STAR exemption savings on our website is 1000.

The total amount of school taxes owed prior to the STAR exemption is 4000. If your income is greater than 250 000 and less than or equal to 500000 you can register online for New York State STAR tax credit or by calling 518-457-2036. Surviving spouses may use the existing Enhanced STAR benefit if they are 62.

How much is NYS Enhanced STAR exemption. For instance if you live in Albany County in the City of Cohoes and your basic STAR exemption is 17340 and your homes assessment is 180000 you would subtract 17340 from 180000 to arrive at your homes value for local school property tax purposes of 162660. The Maximum Enhanced STAR exemption savings on our website is 1000.

The Maximum Enhanced STAR exemption savings on our website is 1000. Provides an increased benefit for the primary residences of senior citizens age 65 and older with qualifying incomes. Enhanced STAR exemptions are calculated the same way except the base amount for the Enhanced STAR exemption in the 2021-2022 school year is 70700 rather than 30000 for Basic STAR.

Commercial horse boarding also qualifies. Please see this NYS link for information. Based on the first 70700 of the full value of a home for the 2021-2022 school year.

You may not get them for city town or county taxes. However STAR credits can rise as much as 2 percent annually. In New York State the homestead exemption known as STAR for School Tax Relief allows homeowners in some counties to deduct as much as 1635 from their property taxes while those over 65 can deduct up to 2940.

The benefit is estimated to be a 293 tax reduction. 20212022 STAR exemption amounts. The total income of all owners and resident spouses or registered domestic partners cannot exceed 92000.

Student Thesis Animation In 2021 Management Case Studies High School Story Change Management

Lab Sling Psychrometer Earth Science Lab Student Work

Incident Report Form Report Template Police Report

Pin On Pictures Of Nursing Exhibition

Pin By Sean Baker Doran On Hot Cars Basic Income Hot Cars

The School Tax Relief Star Program Faq Ny State Senate

New York Seniors Reminded To Upgrade Star Exemption

Mary Kay Mesh Zipper Bag Set Up Mary Kay Party Mary Kay Consultant Mary Kay Facial

Rebate Checks Gone In Nys Star Checks Continue For Now Yonkers Times

Lower Your School Taxes With The New York Star Program

Saturn V Markings John Duncan Saturn John Duncan Lettering

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

The National Weather Service Has Issued A Winter Weather Advisory And Hazardous Weather Outlook For Long Island Winter Weather Advisory Winter Weather Weather

Many Homeowners Face A Choice On How To Best Get Their Star Wgrz Com

Parties Selling Mary Kay Hostess Mary Kay Business Mary Kay Hostess Program

What Is The Basic Star Property Tax Credit In Nyc Hauseit

Tax Rebate Program 480 A Forest Tax Law Nys Dept Of Environmental Conservation Environmental Conservation Law Tax